General overview

This project allows users to apply for credit cards through Experian rather than on an external partner site. By keeping users on the Experian site, it creates a less complicated application process and allows us to keep users on our platform.

For MVP, we featured Ally’s suite of credit cards.

Revenue impact:

This project brings in a lot of revenue for Experian.

- Web: $804k/year

- Mobile: $132k/year

Since this is also a flow that can be repurposed for other credit card partners, it has the potential to bring in even more revenue in the future.

I collaborated with the following people on this project:

- Lead UX Designer

- Project Management Director

- Senior Product Manager

- Ally’s Legal and Compliance team

- Developers

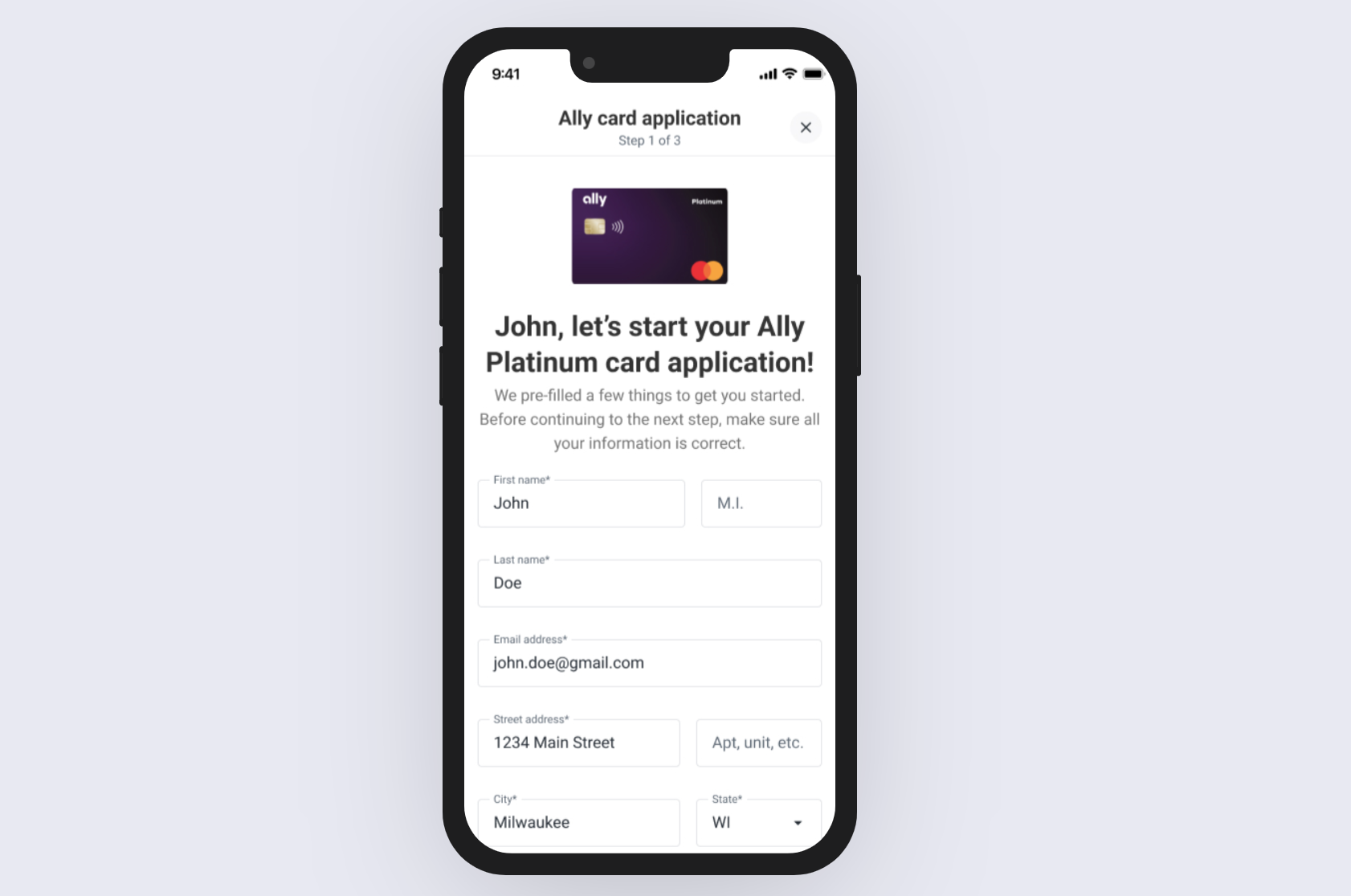

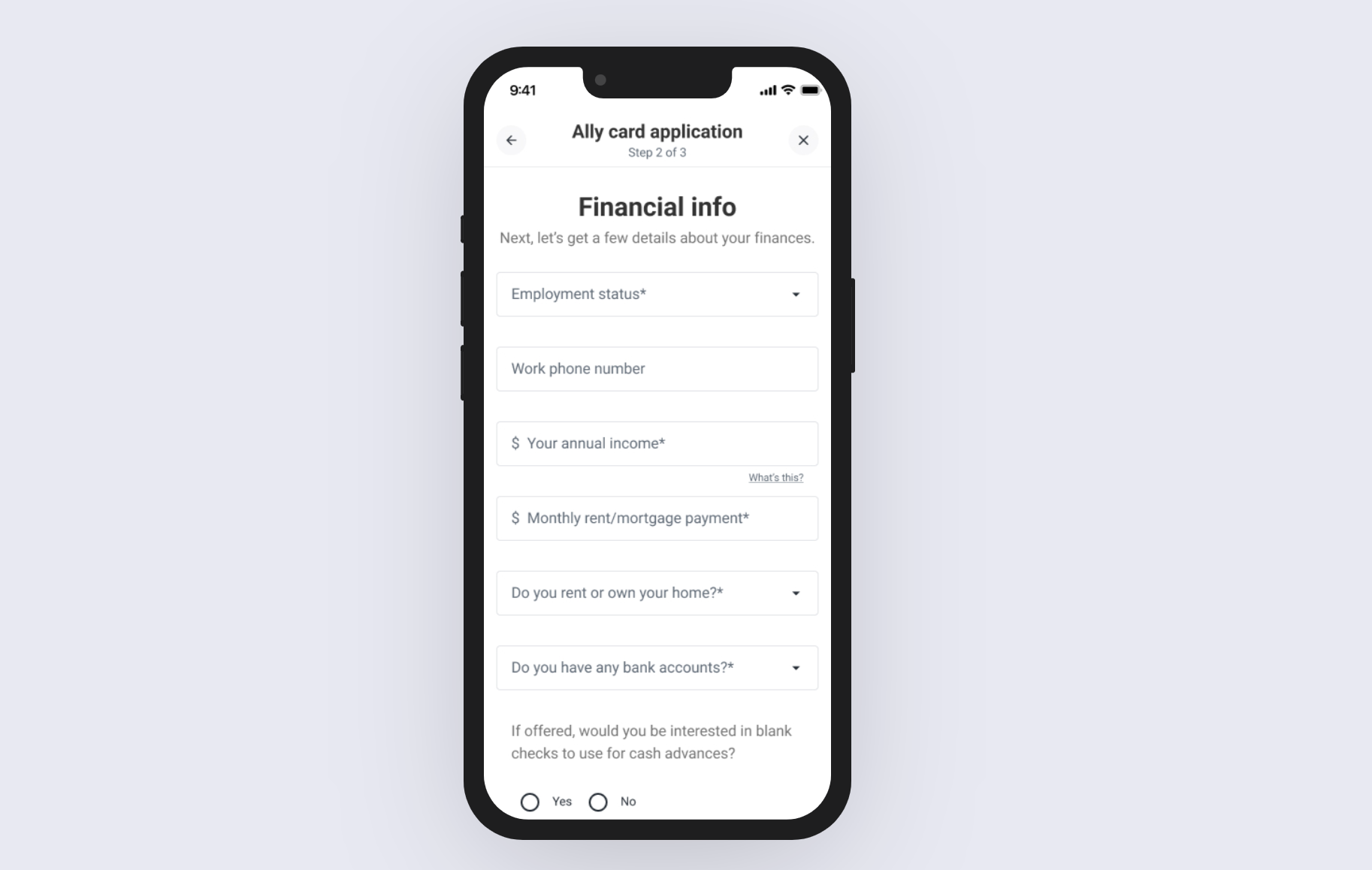

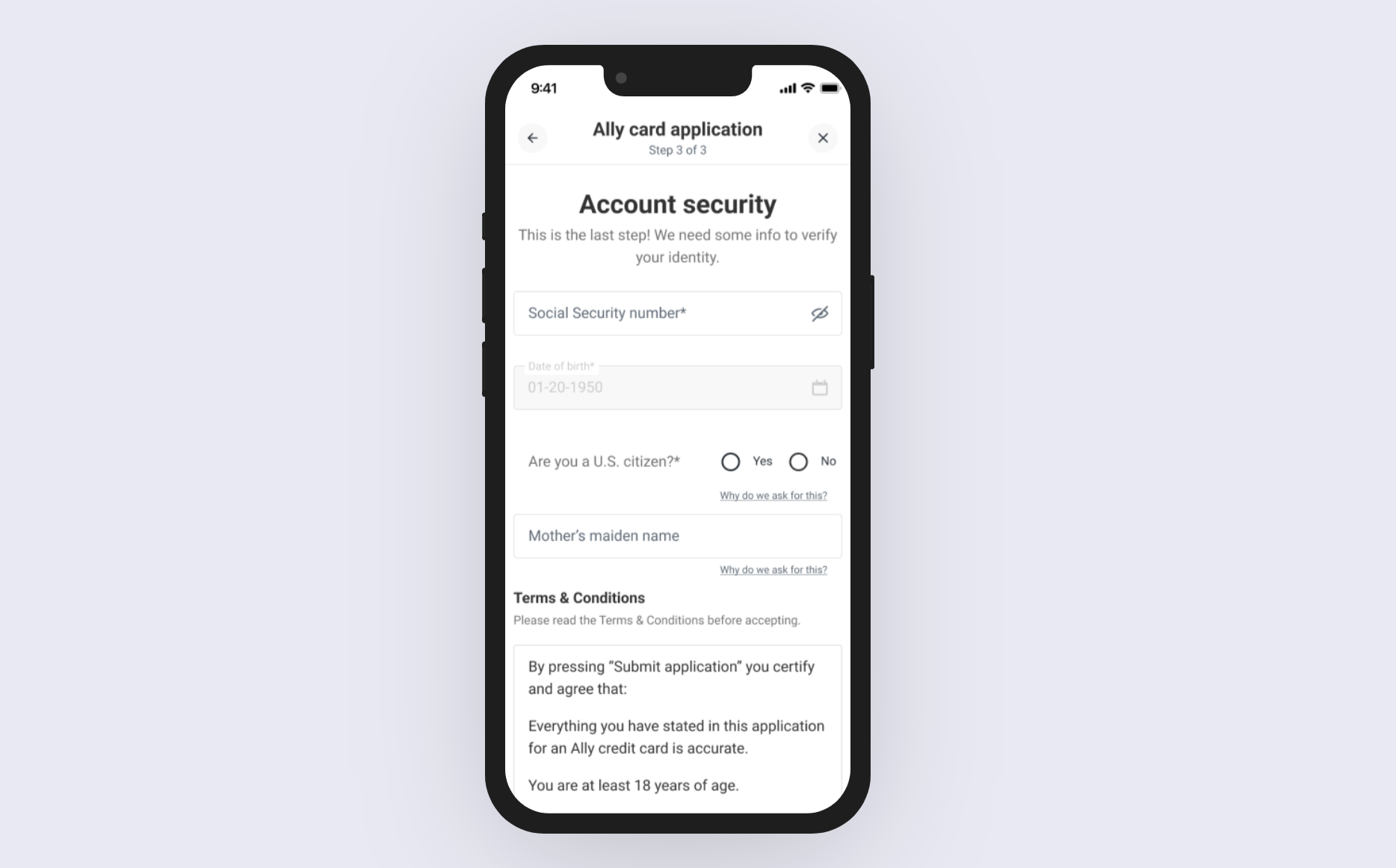

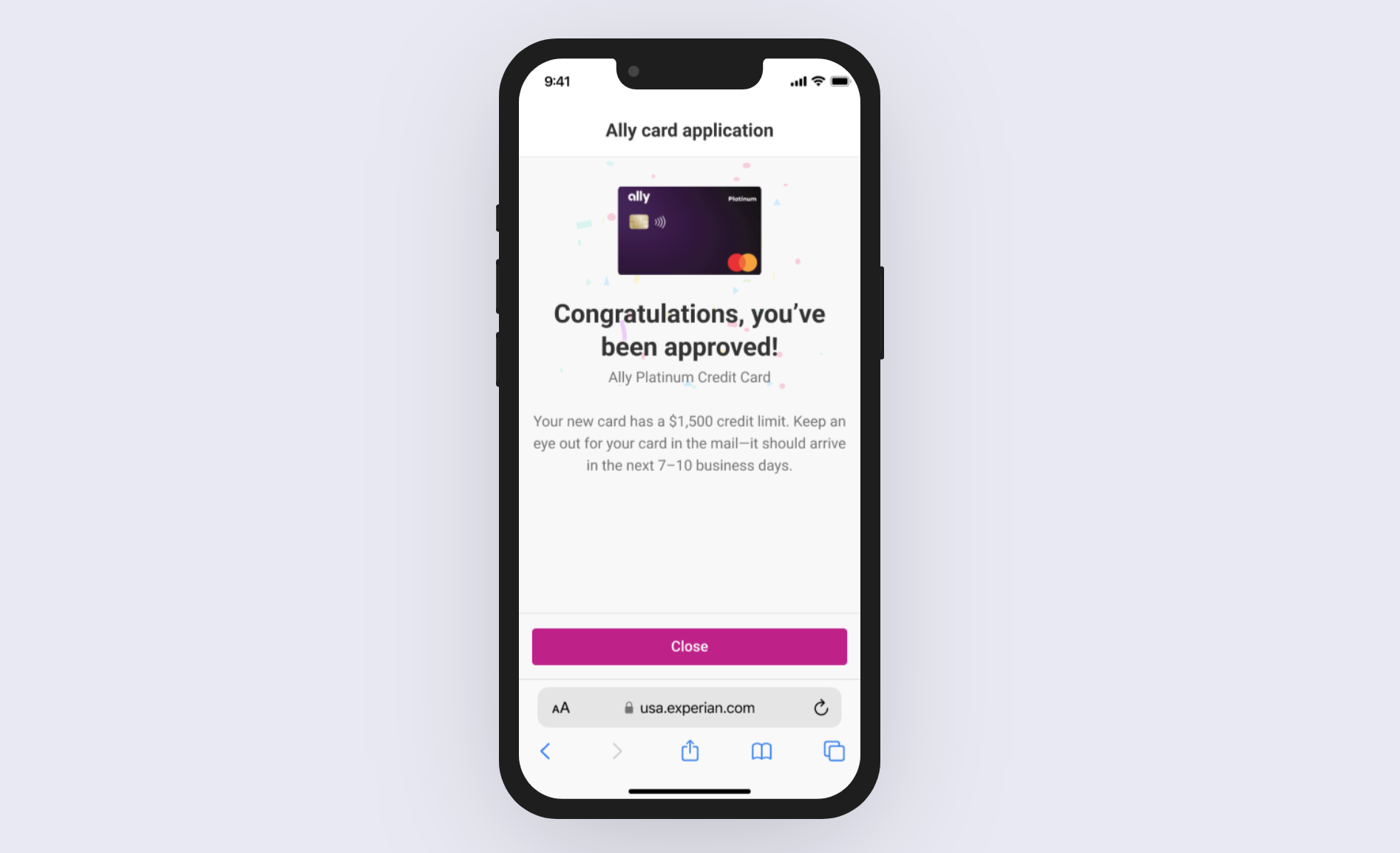

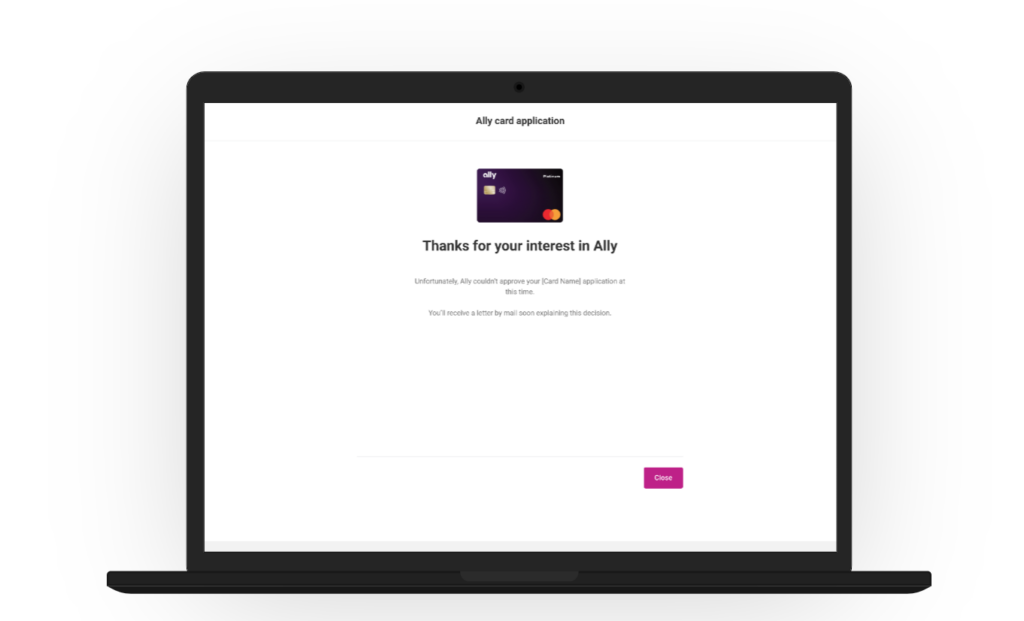

Ally application flow

Project Hurdles

We had a few hiccups along the way, but it wasn’t anything a little problem-solving couldn’t fix! Hurdles included:

- The partner was initially named Ollo, and was in the process of rebranding all of their cards to Ally. To ensure this change was accounted for, I coordinated with our Marketing Compliance team and our Lead UX Designer.

- The Senior Product Manager in charge of this project left Experian. Some legal and UX requirements from Ally got left behind as someone new took over the project. A few copy and design changes had to be made in the middle of development because of this.

Content and compliance constraints

Content and compliance constraints

There were a wide range of credit cards included in this flow—some of which had the word “card” in the actual name. Marketing compliance did not allow any changes to the card name, so I had to creatively craft content to avoid any repeated wording.

Instead of:

- Your Ally Platinum Card card will arrive in the mail shortly.

I reworked the content to ensure the word “card” would not be repeated in any sentences:

- Your Aly Platinum Card application was approved! It’ll arrive in the mail shortly

Project outcomes

This is now live and fully developed! It was well received by stakeholders and immediately started to generate revenue.

Due to its success, we are now working on another application flow with a second partner, Credit One Bank.